Funding Guide

Photo : Sébastien St-Jean

The regional county municipality (MRC) du Golfe-du-Saint-Laurent may, under the support for the

local and regional development of MRCs under the Regions and Rurality Fund included in the

2020-2024 partnership agreement between the Ministry of Municipal Affairs and Housing and

MRC’s, intervene financially in development projects in rural communities.

The purpose of this guide, which includes the fund for Structuring projects and the policy for

Business Support is to provide a framework for the MRC’s development team’s analytical work, to

identify the process to apply for and procedure to follow for accepting financial assistance and to

maximize the socio-economic benefits in the MRC du Golfe-du-Saint-Laurent.

Navigation

Click on the section you wish to consult to be taken directly there.

- Intervention priorities of the MRC

- Generalities

- Rural Development Fund

- Community Support Fund

- Regional Social Programs Support Fund

- Structuring Projects Fund

- Business Support Policy

- Annexe 1 – Entrepreneurship and Economic Diversification Fund

- Annexe 2 – Concertation Entreprise Trade Fund

- Annexe 3 – Social Economy Entreprise Development Fund

- Local Funds

Intervention Priorities of the MRC

- The implementation of its mandate regarding land planning and development of the territory;

- The support to local municipalities in professional expertise or to establish sharing of services (social, cultural, tourist, environmental, technological, or other);

- The promotion of entrepreneurship, support of entrepreneurship and the enterprise;

- The mobilization of communities and support towards the realization of structuring projects to improve living environments, in the areas of social, cultural, economic, and environmental;

- The establishment, funding, and implementation of sectoral agreements for local and regional development with government departments or agencies;

- The support for rural development.

Generalities

The following rules generally apply to all funds. However, it should be noted that specific criteria may be attached to each fund.

Registrar of Quebec companies and Quebec business number (NEQ)

All business owners and organizations (excluding fishers without NEQ, see admissible organizations) must be registered with the Registrar of Quebec companies and be current (up to date) to apply for and benefit from financial assistance.

For persons interested in starting a business – as soon as the MRC receives the duly completed and signed application form indicating the promoter’s intention to start a business and acknowledges receipt thereof, they can register to obtain their NEQ.

Admissible Organizations

Municipal organizations (MRC, municipalities);

Band councils of Innu communities;

Non-profit organizations;

Cooperatives (excluding financial ex: Desjardins, Credit unions);

Businesses, private or social economy, except for private businesses from the financial sector (ex. Investment banking firms, lenders, insurance companies, credit card companies, real estate firms, etc.);

Persons interested in starting a business;

Fishermen without NEQ numbers are admissible to Component 2 of the Structuring Projects Fund only. Fishermen without NEQ are DFO registered license holders. A listing of all permits from DFO is required with the application form.

Territory Served

Eligible organizations must serve, in whole or in part, the municipalities of the MRC du Golfe-duSaint-Laurent (Côte-Nord-du-Golfe-du-Saint-Laurent, Gros-Mecatina, Saint-Augustin, BonneEsperance, Blanc Sablon and the communities of Unamen Shipu and Pakua Shipi).

Admissible projects

To be admissible, a project must:

• Be carried out on the territory of the MRC du Golfe-du-Saint-Laurent;

• Be carried out over a period not exceeding 18 (eighteen) months;

• Meet one or more of the intervention priorities established by the MRC;

• Be supported by confirmed financial contributors;

• Be closed with a final activity report submitted to the MRC agent responsible for the file,

before the end of the project;

It should also be noted that:

- If the project involves the start-up or purchase of an enterprise, it cannot be sold or relocated within three years of the project’s start-up or take-over date (exceptions can be made with a request and approval by the MRC).

- If the project involves a major purchase (boat, boat & motor, vehicle, heavy equipment, etc.), it cannot be sold within five years of the purchase date. Major purchases: the promoter must possess and provide proof of necessary legal qualifications to own and operate with the project application.

Admissible expense

- Capital expenditures such as land, buildings, equipment, machinery, rolling stock, incorporation fees, transportation and other similar expenses;

- The acquisition of technologies, software packages, patents;

- All other costs related to the elaboration and realization of a project.

SALARIES are only admissible under the Structing Projects Support Fund – Component 1, the Regional Social Programs Support Fund and the Social Economy Fund.

Inadmissible organizations

- Sexual, religious, political or any other company whose activities are controversial, and which may be demeaning to persons with whom it would be unreasonable to associate the name of the MRC du Golfe-du-Saint-Laurent.

- Companies registered with the Registraire des entreprises not eligible for public contracts;

- The Register of companies ineligible for public contracts (RENA) records the names of companies that have committed an offence under Schedule 1 of the Act respecting contracting by public bodies (R.S.Q., chapter C-65.1) (LCOP). To access the entire list or search by name or NEQ, https://amp.quebec/rena/

To access the complete list or search by name or NEQ.

Inadmissible expenses

- Expenses related to projects already completed;

- Expenses incurred before the signing of a financial aid agreement by both parties (promoter and the MRC);

- The financing of debt, the repayment of loans or the financing of an already existing or completed project;

- Any form of loan, loan guarantee, equity investment, etc.;

- Real estate assets used as residential and/or commercial properties, or any rental property whose SOLE purpose is to generate revenues through the rental or sale of these properties;

- Any expenditure to move a business or part of its production outside the local municipality where it is located, unless the municipality agrees;

- Any expense made to support a project in the retail or restaurant sector, other than to provide a local service.

To be eligible, a local service in a municipality of the MRC must meet the following criteria:

- The service does not compete with any other similar business in the municipality;

- The service is not located within a 5-kilometre radius of a similar service in another village or municipality;

- The service is essential to the development and diversification of the community.

Infrastructure, services, works or current operations normally funded by municipal budgets or government programs, which include:

- Construction or renovation of municipal buildings;

- Infrastructure, works or operations related to landfill sites, waste processing sites, waterworks and sewer;

- Works or operations related to road works, buildings, power supplies and day to day operations of fire and security services;

- Maintenance of recreational or cultural facilities;

Real estate is defined as anything fixed, immovable, or permanently attached to it which can be bought, leased, sold, or transferred together or separately:

Real estate can be residential which includes properties such as apartments, condos, and houses. Commercial real estate includes office buildings, warehouses, and storage facilities, etc.

Project Analysis

Projects will be analyzed in accordance with, but not limited to the terms of this guide, the criteria established under each respective fund, the financial viability and quality of the financing plan, the innovativeness of the project, the development potential, the socioeconomic impacts, job creation and the impact of the project on the community/territory including market space.

Accumulation of government assistance and promoter contribution

The maximum contribution from the sum of the various government grant sources is 90% of the total cost of the project. Therefore, the promoter is required to inject a minimum 10% monetary contribution to the project.

In the case of projects initiated by private enterprise, the financial assistance cannot exceed 50%. Financial assistance granted to the same beneficiary cannot exceed $150,000 at any time within a period of 12 months.

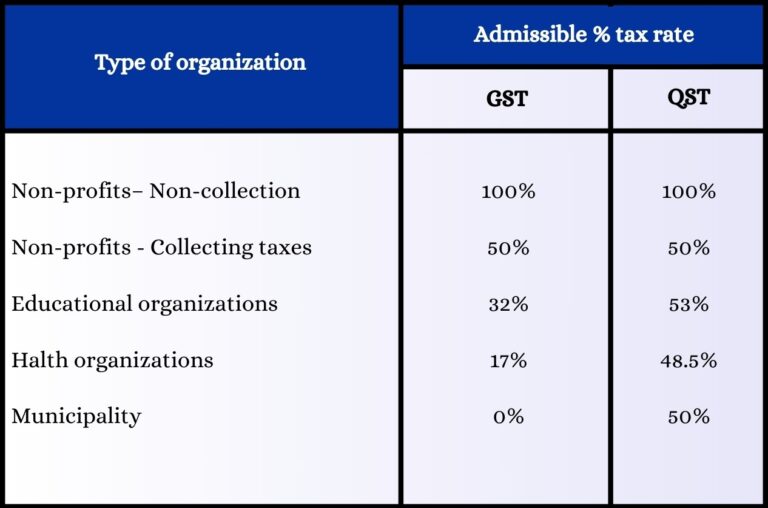

Admissible taxes

Purchasing

Buying local encourages our workers, our businesses, and our economy. The promoter must make the effort to purchase local first (within a 10% difference and a reasonable time frame). If that is not possible, the promoter should give preference to Quebec products or suppliers located in Quebec. If not, the promoter will have to justify the reasons for his purchases outside the province.

Visibility

Promoters who receive financial assistance from the MRC must acknowledge and promote the financial contribution received as stipulated in Article 8.5 of the financial aid agreement.

8.5. The PROMOTER agrees to acknowledge and promote the financial contribution of the MRC by way of either affixing a provided logo (decal or sticker) to the object of the subsidy or by announcing it on a social media platform. The PROMOTER accepts to follow the recommendations for publicity put forth by the MRC in the letter accompanying the first disbursement of funding.

Terms and conditions

All accepted projects will be the subject of a financial aid agreement between the MRC and the promoter. This protocol will define the conditions for the payment of the financial assistance, the related obligations of the parties and the repayment, if applicable.

Application deadlines

Projects can be submitted at any time.

A project will only be analyzed upon reception of, the duly completed and signed application form AND all required supporting documents. The listing of supporting documents can be found on page 1 of the Application form for financial assistance and on pages 1 & 2 of the Application form for private enterprises.

The general response time after an agent begins analysis is 30 to 60 days. Note that additional documents may be requested during this process.

Project completion

As of the signing of the financial aid agreement by all parties, the promoter will have *18 months to complete their project and submit the final report, accompanied by supporting documents

relating to the expenses incurred for the implementation of the project.

The final report, duly completed and signed must include:

• All invoices and proof of payment relative to the project

• Copies of payroll, if applicable

• Photos of the financed project and/or a photo portraying the publicity of the MRC’s

financial contribution to the project.

Requests for extensions must be submitted in writing and must be justified. If granted, extensions should not exceed 6 months.

Funding disbursement

Funding is generally disbursed in two parts: 80% upon reception of signed financial aid agreement and the remaining 20% upon reception of the final report and supporting documents. Some exceptions may apply depending on the nature of the project.

* It is important to note that once an organization accepts the first disbursement, they are required to complete the total project. If not completed, the amount of the first disbursement must be reimbursed to the MRC.

Follow-up of files

Follow-ups are essential to ensure the smooth execution of the project and that the projects will be completed on time. Follow-ups will be done at the 3, 6-, 9-, 12- and 15-month marks. Additional follow-ups may be done at the discretion of the agent depending on the nature of the project.

Investment decision

Investment decisions are made by the council of the MRC following a recommendation of the agent. Some exceptions apply.

How to apply for financial assistance

Application forms are available on the MRC website www.mrcgsl.ca or by contacting one of the MRC offices.

• Complete an application form for financial assistance

• It is important that as a promoter, the name of your organization/business is written on the application form exactly as it appears in the Registrar of Quebec companies. (Not applicable for persons wanting to start a business or fisherpersons without NEQ numbers)

• Attach ALL supporting documents. (Listing is found on page 1 of the Application

form for financial assistance and pages 1 & 2 of the Application form for private

enterprises)

• Ensure that all financial partners are confirmed in writing and that all support

letters (including those of intent to upkeep if the support is from a municipality)

are attached.

• Submit the duly completed and signed application form with all supporting documents to info@mrcgsl.ca

What happens once an application is submitted?

Once an application form is received at the MRC, the following is validated:

• The application form is completed and signed

• The online registry is complete and current

• Supporting documents are attached

An email is sent to the promoter informing them that their project is being transferred to an agent (identified in the email and in cc) and that the agent will work with them and may request additional documents or require more information in the analysis phase. The agent responsible for the project will make initial contact with the promoter within 2 days. The agent is responsible to ensure regular follow-ups throughout the entire process.

Projects are analyzed in accordance with the terms of this guide and the criteria established under each respective fund and recommendations are made to the council of the MRC.

Once decisions are rendered by the council of the MRC, the agent will contact the promoter to inform them of the decision and if accepted, send the financial aid agreement for signature.

The financial aid agreement can be signed and emailed to the MRC at info@mrcgsl.ca (The originals do not need to be mailed). The date of reception of the email will be the day the agreement is signed by the MRC.

It is important to note that any expenses incurred prior to that date are not admissible.

Rural Development Fund

Objective :

The objectives of rural development fund are :

- To promote the growth and integration of the population ;

- To add value to human, cultural and physical resources of the region ;

- To assure the survival of rural communities;

- To maintain the balance between quality of life, lifestyle, natural environment and economic activities ;

- The well-being of the population (sports and leisure) ;

- Job creation ;

- Communication :

- Access to new technology ;

- Transfer of knowledge ;

- Access to new technology ;

- Local services :

- Social programs ;

- Improved community services and equipment ;

- Transport ;

- Environment ;

- Community development.

Admissible organizations :

- Municipality, municipal body and MRC, as well as the band council of a designated aboriginal community ;

- A non-profit organization ;

- Solidarity and consumer cooperatives ;

- Organizations in the education, health, culture, environment, heritage, or social services networks covering all or part of the territory.

Admissible/inadmissible expenses :

In addition to the list of admissible expenses outlined on page 5 :

- Working capital for the first year of operation.

In addition to the list of inadmissible expenses outlined on page 6 :

- Salary/labor cost ;

- Fire services and safety.

Financial assistance is in the form of a grant that cannot exceed $25,000 per project.

Community Support Fund (CSF)

Objective

This fund assists in offsetting the costs to local organizations, clubs, groups and individuals involved in events or initiatives which have a positive impact for the recipient, local residents and the community as a whole.

Nature of financial assistance

The amount of funding granted under the CSF will be determined at the discretion of the council of the MRC upon receipt of the application form and supporting documents.

This fund has an annual budget of $5,000.

Any disbursement made under this fund will not be done in the traditional manner of two (2)

installments (80% and 20% respectively) but rather by the payment of a specific invoice to a supplier.

Regional Social Programs Support Fund

Objective

To assist in the stabilization and continuity of social programs through partnerships.

Regional based initiatives are defined as recurring activities that are present in one or municipalities on the territory of the MRC du Golfe-du-Saint-Laurent that have direct intervention with the population and are addressing a need in the community or communities involved.

Projects involving youth, families and seniors are prioritized.

Admissible organizations

- Municipal organizations ;

- Non-profit organizations ;

- Organizations from the education sector ;

Admissible/inadmissible expenses

In addition to the list of admissible expenses outlined on page 5 :

- Salaries and wages for the realization of the project including the MandatoryEmployment Related Costs (MERC’s) and social benefits for Animation purposes only.

*ADMISSIBLE ONLY TO 75% OF THE TOTAL PROJECT COST. - Salaries relative to the Coordination of a program or administrative costs relative to the management of a program are admissible only to a maximum of 5% of the total project cost and must be justified.

- The purchase of materials (reading, recreational, etc.) relative the program.

- Inadmissible expenses are outlined on page 6.

Financial assistance is in the form of a grant that cannot exceed $20,000 per year for a maximum of 3 years, provided that the promoter commits to providing on a regular basis, statements of revenues and expenditures.

It is also important to note that financial assistance will be granted proportionate to the number of people and communities impacted.

The structure of payments could fluctuate depending on the needs of the organization and would be specified in the financial aid agreement between the promoter and the MRC.

Project analysis criteria

Projects submitted under the Regional Social Programs Support Fund will be analyzed based on the following factors:

- Partnerships formed/secured for the implementation/continuation of the program within communities, including support from Municipalities ;

- Job creation/maintenance ;

- Community mobilization¹;

- Sustainability² of the project ;

¹Community mobilization: a process whereby local groups are assisted in clarifying and expressing their needs and objectives and in taking collective action to attempt to meet them. It emphasises the involvement of the people themselves in determining and meeting their own needs.

²Sustainability: the ability to maintain or support a process continuously over time.

Structuring Projects Fund

Objective

In conformity with the objectives of the Agreement on the Regions and Rurality Fund – Component 2 Support for local and regional development, the MRC du Golfe-du-Saint-Laurent has implemented the Structuring Projects Support Fund to improve living conditions.

This fund has 3 components :

Component 1: General Fund

To be eligible for funding under Component 1, admissible businesses or organizations must be registered under the Registrar of Quebec Companies and current (up to date). For persons wishing to start a business, see precision on page 5.)

A structuring project is a project that demonstrates growth¹, has an impact on the economy² and that fall in line with the MRCs intervention priorities.

¹demonstrates growth: growth in rural areas is defined as the process of improving the quality and economic well-being for its residents.

²impact on the economy: creating and maintaining jobs, contributing to sustainable development and diversification.

³diversification: act of manufacturing a variety of products or selling a variety of merchandise not currently available on the territory.

The following fields of intervention are prioritized : Fishery; Aquaculture; Agrofood; Tourism and Culture; Leisure; Economic diversification; Labour training; Transportation; Telecommunications; Environment.

Projects involving youth, families and seniors are also prioritized.

Admissible organizations/businesses

- Municipal organizations ;

- Band councils of Innu communities ;

- Cooperatives (except financial) ;

- Non-profit organizations ;

- Organizations from the education sector ;

- Businesses, private or social economy (except financial) ;

- Persons interested in starting a business.

Admissible/Inadmissible expenses

In addition to the list of admissible expenses found on page 5 :

- Salaries and wages for the realization of the project including the Mandatory-Employment Related Costs (MERC’s) and social benefits. However, salaries including MERCs and social benefits are only admissible at 50% of the project cost to a maximum amount of $17,500 per project.

- Professional fees ;

- Inadmissible expenses are outlined on page 6.

Financial assistance is in the form of a grant that cannot exceed $35,000 per project.

Project analysis criteria

Projects submitted under the Structuring Projects Support Fund will be analyzed based on the following factors :

- Structuring aspect of the project; (definition on page 15).

- Projects supporting devitalized territories¹;

- Job creation/maintenance ;

- Community mobilization ; (definition on page 14)

- Sustainability of the project ; (definition on page 14)

¹Devitalized territories: According to the Economic Vitality Index at the Institut de la statistique du Québec, the whole

of the MRC du Golfe-du-Saint-Laurent is classified as Q5 while the municipalities within are classified as such :

- Municipalité de la Côte-Nord du Golfe-du-Saint-Laurent – Q4

- Municipalité de Gros-Mécatina – Q5

- Municipalité de Saint-Augustin – Q5

- Municipalité de Bonne-Espérance – Q5

- Municipalité de Blanc Sablon – Q4

Component 2: Fishery Fund

The fishing industry is the main industry of the devitalised Lower North Shore. To assist in thesustainable development of the industry. The fishery fund component of the Structuring projects fund is intended to provide financial assistance to Fisherpersons¹ to assist and contribute to safer and more efficient fishing.

Registered fishing enterprises, including persons interested in starting a registered fishing enterprise are NOT admissible to this component, they are admissible to Component 1.

Under this component, fisherpersons are eligible to 50% of admissible expenses, up to a maximum of $35,000.

This component CANNOT be combined with any other component of this fund nor with any other fund. Projects will be accepted until funds have been exhausted.

The following expenses are admissible :

- Boats, motors, trailers, storage facility.

- Modifications to boats (ex. stabilizers, enlargement/reduction).

- Equipment, including safety equipment (ex. Sounders, radar, GPS, hauler, pump, survival suits, floaters, etc.)

- Nets, traps (pots), buoys (poly float markers), rope, etc.

- Freezers may be considered as an eligible expense provided that the applicant has a bait license and provides proof thereof. A maximum of 2 freezers can be requested per project.

- Any other expense deemed essential to the industry.

If the project involves a major purchase³ (boat, motor, boat & motor, trailer, storage, etc.), it cannot be sold within five years of the purchase date.

³Major purchases: the promoter must possess and provide proof of necessary legal qualifications to own and operate with the project application.

The following expenses are not admissible :

- Salaries ;

- Expenses related to projects already completed ;

- Expenses incurred before the signing of a financial aid agreement by both the promoter and the MRC ;

- The financing of debt, the repayment of loans or the financing of an already existing or completed project ;

- Any form of loan, loan guarantee, equity investment, etc. ;

- Real estate assets (real estate is defined as anything fixed, immovable, or permanently attached to it which can be bought, leased, sold, or transferred together or separately).

IMPORTANT TO NOTE : Fisherpersons requesting funding under this component must demonstrate that they either FISH

a portion of their product or SELL a portion of their product on the territory of the Lower North Shore and that it has an impact on the economy of the Lower North Shore, whether directly or indirectly.

- Exemple of direct impact : a fisherperson who sells his products directly to a fish processor onthe territory.

- Example of indirect impact : a fisherperson who sells his products to a fish processor off the territory, but that fish processor employs people from the territory

IN ADDITION, promoters must give preference to Quebec products or suppliers located in Quebec. If not, the promoter will have to justify the reasons for his purchases outside the province.

¹for the purpose of this component, Fisherpersons are defined as without NEQ but are DFO registered license holders. A listing of all permits from DFO is required with the application form.

Component 3: Creating an online presence and training

Having a strong online presence is essential. It enhances accessibility, it reaches a wider audience, it builds customer relations, etc. Under this component, promoters can apply for funding to assist in the cost of creating or improving an online presence (Websites (new or re-vamping), social media marketing, E-commerce, Google My Business registration, etc.)

Financial assistance is in the form of a grant covering 50% of the cost up to a maximum of $ 5,000 per project for private enterprises, 90% for non-profit organizations.

Assistance under this component is one-time only and can be combined with Component 1.

Training

Allow promoters that have been approved for funding to create an online presence to receive training and to ensure that once the tools are created, promoters know how to maintain them.

A promoter may be reimbursed 100% of training fees up to a maximum of $ 1,000. Eligible expenses include registration fees, materials and other costs related to the promoter’s participation in approved training activities.

Business Support Policy

Objective

In conformity with the objectives of the Regions and Rurality Funds – Component 2 Support for local and regional development, The MRC du Golfe-du-Saint-Laurent is implementing this Business Support Policy.

This policy aims to :

- Promotes the creation and/or maintenance of sustainable jobs ;

- Offer continuous support to entrepreneurs with the realization of their project (business plan, studies, references) ;

- Promote social development and support the promoters of social economy enterprises ;

- Accompany, support technically and/or financially potential entrepreneurs or those already in

business (consulting, orientation, referral activities, training support) ; - Offer and manage the programs offered to our clients (support for self-employed workers (SEA), employment assistance services) ;

Business loans are also offered: information can be found in the Common Investment Policy on the website of the MRC.

GENERAL INFORMATION

This section is intended to provide general information about the Business Support Policy. However, it should be noted that specific criteria may be attached to each fund in the definition of available funds in the annexes.

Registrar of Quebec companies and Quebec business number (NEQ)

All promoters must be registered with the Registrar of Quebec companies and be current (up to date) to apply for and benefit from financial assistance.

Persons interested in starting a business – as soon as the MRC receives the duly completed and signed application form indicating the promoter’s intention to start a business, they can register to obtain their NEQ.

Territory served

Eligible organizations must serve, in whole or in part, the municipalities of the MRC du Golfe-du-Saint-Laurent (Côte-Nord-du-Golfe-du-Saint-Laurent, Gros-Mecatina, Saint-Augustin, Bonne-Esperance, Blanc Sablon and the communities of Unamen Shipu and Pakua Shipi).

Admissible organizations

- Cooperatives (except financial) ;

- Non-profit organizations ;

- Municipal organizations ;

- Private or social economy enterprises (except financial) ;

- Individuals wishing to start a business ;

Admissible expenses

- Capital expenditures such as land, buildings, equipment, machinery, rolling stock, incorporation,

transportation, installation and other similar expenses ; - Expenditures for the acquisition of technology, software or software packages, patents, and any

other similar expenditures.

Inadmissible expenses

- Expenses related to projects already completed ;

- Expenses incurred before the signing of a financial aid agreement by both the promoter and the MRC ;

- The financing of debt, the repayment of loans or the financing of an already existing or completed project ;

- Any form of loan, loan guarantee, equity investment, etc.;

- Real estate³ assets used as residential and/or commercial properties, or any rental property whose SOLE purpose is to generate revenues through the rental or sale of these properties ;

- Any expenditure to move a business or part of its production outside the local municipality where it is located, unless the municipality agrees ;

- Any expense made to support a project in the retail or restaurant sector, other than to provide a local service*.

To be eligible, a local service in a municipality of the MRC must meet the following criteria :

- The service does not compete with any other similar business in the municipality.

- The service is not located within a 5-kilometre radius of a similar service in another village or municipality.

- The service is essential to the development and diversification of the community.

³Real estate is defined as anything fixed, immovable, or permanently attached to it which can be bought, leased, sold,

or transferred together or separately :

Real estate can be residential which includes properties such as apartments, condos, and houses. Commercial real

estate includes office buildings, warehouses, and storage facilities, etc.

Project Analysis

Projects will be analyzed in accordance with, but not limited to the terms of this guide, the criteria established under each respective fund, the financial viability and quality of the financing plan, the innovativeness of the project, the development potential, the socioeconomic impacts, job creation and the impact of the project on the community/territory including market space.

Accumulation of government assistance and promoter contribution

The maximum contribution from the sum of the various government grant sources is 90% of the total cost of the project. Therefore, the promoter is required to inject a minimum 10% monetary contribution to the project.

In the case of projects initiated by private enterprise, the financial assistance cannot exceed 50%.

Financial assistance granted to the same beneficiary cannot exceed $150,000 at any time withina period of 12 months.

The Funds (in Annexe)

Annexe 1 – Entrepreneurship and Economic Diversification Fund (EEDF)

Annexe 2 – Concertation Enterprise Trade Fund (CETF)

Annexe 3 – Social Economy Enterprise Development Fund (SEF)

Annexe 1 - Entrepreneurship and Economic Diversification Fund

Objective

This fund aims to support entrepreneurs including young entrepreneurs (between the ages of 18 and 40) who wish to start a new business, acquire an existing business, expand, or diversify, and whose objective is to contribute to the economy of the MRC du Golfe-du-Saint-Laurent.

This fund has 2 components:

Component 1: Creation or acquisition of a business and Training

Start-up of a business, legally constituted¹ by the promoter or acquire shares¹ in an existing business on the territory of the MRC.

¹Shares – a promoter requesting funding to purchase shares in an existing business must, at the end of the transaction become the majority shareholder and own a minimum of 51% of the shares.

Financial assistance is in the form of a grant of $ 12,500 per project. An additional $ 2,500 is granted to the promoter if they are between the ages of 18 and 40. The amount of financial assistance may not exceed $ 15,000 per project. (Maximum of 2 promoters²).

²in the case of 2 promoters, funding will be determined according to share declaration. Whether it is promoter 1

or promoter 2, one of them must hold at least 51% of the business’s shares.

Training

Allow promoters who have been approved for funding for start-up or acquisition of shares to benefit from financial aid for training relative to their project.

Eligible training may include :

- Training courses offered via the Internet or correspondence ;

- Training seminars offered by business support or business development organizations or associations ;

- Business skills training and counselling designed to enhance the client’s overall knowledge in business related skills ;

Costs associated with providing business skills training to potential entrepreneurs or existing entrepreneurs that can be in the form of, but not limited to, one-on-one consultation, classroom style courses, seminars and conferences, in areas such as :

- Accounting/bookkeeping; Strategic planning; Cash management and profitability; Food and staff costs; Marketing and promotion; Business networking; Food handling; Public relations.

A promoter may be reimbursed 100% of eligible training expenses up to a maximum of $1,000. Eligible expenses include registration fees, materials and other costs related to the promoter’s participation in approved training activities.

Component 2 : Expansion¹ or diversification

Increase a business’ capacity, enlarging its scale by offering additional products and services or manufacturing a variety of products or selling a variety of merchandise.

This component also includes feasibility, opportunity, and marketing studies.

¹Expansion : : A business does not need to be in operation for a set amount of time before submitting an expansion project. The promoter needs to justify the need for expansion in his project application.

Financial assistance is in the form of a grant of $ 12,500 per project. An additional $ 2,500 is granted to the promoter if they are between the ages of 18 and 40. The amount of financial assistance may not exceed $ 15,000 per project.

For components 1 and 2: promoters must possess appropriate experience or training in the business, and they must commit to working full-time in the business.

Admissible expenses

In addition to the list of admissible expenses on page 21 of the Business support policy :

- Legal and professional fees and any other fees incurred for the consultation of specialists required to carry out studies.

Annexe 2 - Concertation Entreprise Trade Fund

Objective

This fund has dual objectives:

1) Concertation : The actions of many people working together for a common goal. This funding is available to assist in the financing of forums (fishery, tourism, etc.), assemblies and meetings to discuss issues pertaining to a specific industry, including the development of strategies within the sectors of the economy involved or in the development of the territory of

the MRC.

2) Enterprise trade : To support the growth of the Lower North Shore’s business activities through market penetration and expansion. Financial assistance is available for attending trade shows, conventions, conferences or other similar events.

Admissible businesses

This fund is open for all types of businesses: proprietorships, partnerships, corporations, forprofit (except financial) and non-profit organizations, cooperatives (except financial) and associations.

Admissible expenses

Concertation activities : The MRC will determine, upon receipt of the registration form (Appendix D1), the eligible amount for the event. Reimbursement will be made upon presentation of supporting documents.

Enterprise trade : Admissible expenses include transportation, lodging, meals and registration fees (if applicable). The maximum contribution is $ 4,000 per promoter per calendar year (January to December).

Important to note :

- Given that the council meets monthly and that the decisions to attend events need to made quickly, exceptionally under the Enterprise Trade fund only – expenses can be incurred prior to a decision of the council of the MRC. The promoter can submit a request for reimbursement (Appendix D2) with receipts upon return BUT the promoter is aware that by doing this, they may or may not be reimbursed any or all their expenses.

- Airline tickets purchased under the Regional Air Access Program (RAAP) are not eligible for reimbursement as the program from the MTQ stipulates that these trips are for personal use only and not business or work purposes.

This fund has a maximum annual budget of $ 20,000.

- For-profit organizations: The promoters’ contribution must represent 50% of the total project cost.

- Non-profit organizations: The promoters’ contribution must represent 10% of the total project cost.

Annexe 3 - Social Economy Enterprise Development Fund

This fund aims to support the development and the growth of social economy, i.e. production of goods and services by organizations built on a community-based entrepreneurship. These projects, financially viable, and socially inclined will contribute to improving the quality of life and community development.

Admissible organizations/businesses

- All incorporated non-profit organizations ;

- Cooperatives

“Social economy” means all the economic activities with a social purpose carried out by enterprises whose activities consist in the sale or exchange of goods or services, and which are operated in accordance with the following principles :

- The purpose of the enterprise is to meet the needs of its members or the community;

- The enterprise is not under the decision-making authority of one or more public bodies within the meaning of the Act respecting Access to documents held by public bodies and the Protection of personal information (chapter A-2.1) ;

- The rules applicable to the enterprise provide for democratic governance by its members ;

- The enterprise aspires to economic viability ;

- The rules applicable to the enterprise prohibit the distribution of surplus earnings generated by its activities or provide those surplus earnings be distributed among its members in proportion to the transactions each of the members has carried out with the enterprise ;

- The rules applicable to a legal person operating the enterprise provide that in the event of its dissolution, the enterprise’s remaining assets must devolve to another legal person sharing similar objectives.

For the purposes of the first paragraph, a social purpose is a purpose that is not centred on monetary profit, but on service to members or to the community and is characterized by an enterprise’s contribution to the well-being of its members or the community and to the creation of sustainable high-quality jobs.

A social economy enterprise is an enterprise whose activities consist in the sale or exchange of goods or services, and which is operated, in accordance with the principles set out in the first paragraph, by a cooperative, a mutual society or an association endowed with legal personality. (2013, c. 22, p. 3.)

Projects falling within the definition of social economy have certain characteristics thatdifferentiate them from traditional private sector projects. These characteristics are :

- The promoter ;

- The definition of the market ;

- The feasibility of the project ;

- The financing and viability of the project ;

- Job creation and human resources management ;

- The economic and social profitability of the project:

- Respond to the social needs of its members or the community ;

- Create sustainable employment ;

- Aim to create economic and social sustainability ;

- Be in the start-up or expansion and diversification phase ;

- Obtain the investments as forecasted in the business plan ;

- Aim to complete operational and financial autonomy.

All projects will be assessed on a case-by-case basis.

Financial assistance is in the form of a grant that cannot exceed $10,000 per project.

The promoter’s contribution must represent 10% of the total project cost.

Create or maintain 1 permanent job over the next two 2 years ;

SOCIAL ECONOMY BUSINESS

With regards to non-profit organizations created constituted under Part III of the Companies Act, only social economy

businesses are admissible to the Local Funds* if they respect the following conditions :

- Production of goods and services of social value ;

- Democratic management process ;

- Importance of people over capital ;

- Collective empowerment ;

- Impact on local and community development: notably the creation of sustainable employment, the

development of new services and the improvement of the quality of life ; - Apply the entrepreneurial philosophy through their management techniques ;

- Operate on a market economy basis ;

- Have completed the implementation and start-up phases ;

- Be in the expansion phase ;

- Have a majority of permanent employment (not subsidized by one-time programs); in addition to the

quality of employment, they should replace employment from the public or para public sectors ; - Have a net worth of at least 15% of the total assets ;

- Be able to self-finance at 60% (the sources of income represents 60% of the total revenue and could

include governmental and contractual agreement).

Local Funds

The portfolio of the Local Funds must consist of up to 25% of social economy businesses.

The Local Funds does not intervene in any housing projects. However, in the context of the development of services for tenants or residents, the Local Funds can finance, for example, projects for equipment purchases or to establish structures to improve the quality of living.

Also, organizations that are under the jurisdiction of the Government of Quebec or that manage a program under the jurisdiction of the Government of Québec are not eligible, such as subsidized daycares (CPE), homecare services, perinatal centers, educational services, housing, and the Regional County Municipalities (MRC or the equivalent).

*Local Funds refers to the Local Investment Fund and Local Solidarity Fund (FLI/FLS) – Please refer to the Common Investment Policy on the website of the MRC.